PLEASE READ AND UNDERSTAND THESE KEY 1031 EXCHANGE RULES!

A. YOU MUST BEGIN YOUR EXCHANGE PRIOR TO SELLING YOUR RELINQUISHED PROPERTY.

To begin an exchange with us you must hire us BEFORE CLOSING ON YOUR RELINQUISHED PROPERTY. Once you have closed the sale of your property you are no longer eligible to begin an exchange. This is because the IRS considers you in “constructive receipt” of the proceeds from your sale once you have direct control over the funds. Once that is the case, any taxes on your gains are considered due that tax year.

B. YOU MUST IDENTIFY WITHIN 45 DAYS AND CLOSE WITHIN 180 DAYS.

There are two DEADLINES in an exchange starting the day after the first relinquished property is transferred:

- 45 days to identify replacement properties. You can read more about identifying properties HERE

- 180 days to close on the identified replacement property.

C. THE CRITICAL 45-DAY IDENTIFICATION MUST BE IN WRITING AND SIGNED BY THE TAXPAYER.

The property descriptions must be unambiguous by address or legal description. If buying a partial interest, the percentage must be identified as well.

IMPORTANT NOTE

The identification list CANNOT BE CHANGED after the 45th day. The identification does not mean you have to have a contract to purchase. Since the list cannot change after the 45th day, we strongly recommend having a contract to purchase replacement property by the 45th day.

There are three rules for identifying replacement property:

- Three Property Rule: List three properties of any value. This is the simplest and most commonly used identification rule.

- 200% Rule: If the list has more than three properties, the combined list value cannot exceed 200% (or two times more) than what was sold.

- 95% Rule: If the list has more than three properties and the list value exceeds two times what was sold, then 95% of the list must be purchased.

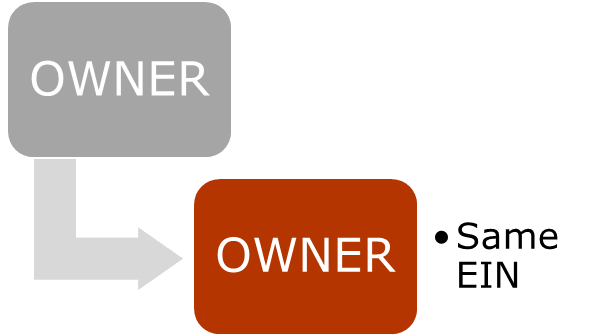

D. THE SAME TAXPAYER THAT SELLS MUST BE THE ONE WHO BUYS.

To defer ALL federal capital gain taxes the same taxpayer that sold the relinquishing real property must purchase property equal to or greater than the VALUE of the real property sold and reinvest all of the CASH proceeds.

This means, for example, if your property is held in an LLC that files its own tax return, it must be the taxpayer that purchases the replacement property.

E. Cash Out: There are only four instances when escrow funds can be released to you.

- You may request cash out at the relinquished closing. This cash out (boot) is taxable.

- If you don’t submit an identification list by the 45-day deadline, the exchange stops, and the escrow funds are released the following business day.

- Once ALL of the eligible properties on the identification list have been purchased, any excess funds will be released to you.

- If you have cash left over, or have not purchased replacement property at the end of the 180 day exchange period, your funds will be released to you.

IMPORTANT NOTE

Once the identification is made and the 45th day has passed, exchange funds cannot be released until all the eligible identified property has been purchased or the 180-day exchange period has expired.

F. IMPROVEMENTS MUST BE COMPLETED BEFORE PURCHASING REPLACEMENT PROPERTY (performed prior to closing). 1031 escrow funds cannot be used for improvements after you own the property.

G. DO NOT GET TOO LARGE OF A LOAN

Borrowing too much on the replacement purchase would cause escrow cash to be released to you at closing. This cash out (boot) is taxable.

H. DO NOT BUY FROM DIRECTLY RELATED PARTIES: Related parties are:

- parents

- siblings

- children

- grandchildren or

- entities collectively controlled by directly related parties.

There are very few exceptions to this rule.